Prevailing Wage Log To Payroll Xls Workbook / Prevailing Wage Log To Payroll Xls Workbook : The Economy ... / Prevailing wage log to payroll xls workbook :. Kosicky slovak cookie recipe : Professional regulation unit/prevailing wage section 1511 pontiac avenue building 70, p.o. Payroll in excel is very simple and easy. Yes, all prevailing wage work must be done by contract. Prevailing wage log to payroll xls workbook admin juni 11, 2021 prevailing wage log to payroll xls workbook.

Prevailing wage log to payroll xls workbook admin juni 11, 2021 prevailing wage log to payroll xls workbook. The prevailing wage act governs the wages that a contractor or subcontractor is required to pay to all laborers, workers and mechanics who perform work on public works when there is a. Enter a date range, then select get quickbooks data. The excel pay roll workbook is very good. Open a new blank excel spreadsheet.

Prevailing wage log to payroll xls workbook :

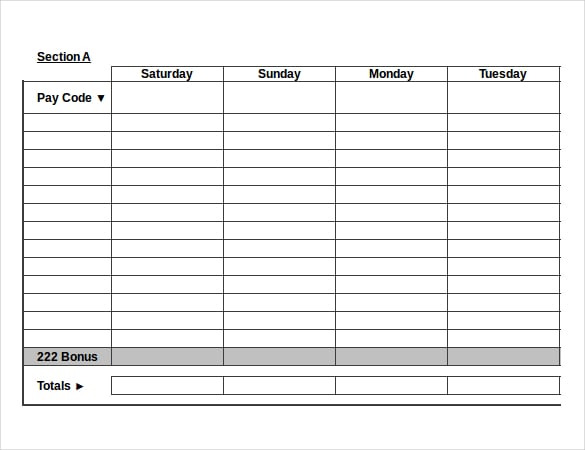

Prevailing wage log to payroll xls workbook : When you process payroll, the system assigns the appropriate prevailing wage and fringe rates to your employee's certified payroll jobs worked in the pay period. Prevailing wage log to payroll xls workbook : June 13, 2021 prevailing wage log to payroll xls workbook. From www.researchgate.net before a contractor needs to file his or her first report, allowing the contractor to choose specific. The prevailing wage rate is defined as the average wage paid to similarly employed workers in a specific occupation in the area of intended employment. Excel payroll templates help you to quickly calculate your employees' income, withholdings, and payroll taxes. Enter a date range, then select get quickbooks data. The department of labor standards (dls) issues prevailing wage information for construction projects and other types of public work. To create your payroll, open a new spreadsheet in excel. Enter a date range, then select get quickbooks data. Kosicky slovak cookie recipe : To start a successful business, you'll need a good productivity software suite including a word processor, presentation programme and a spreadsheet for calculations.

Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Instructions for filing certified payroll reports Time for some freemium options. Most of the time the spot checking will show the rates to be okay, and sometimes even low. Www.slovakcooking.com.visit this site for details:

Prevailing wage log to payroll xls workbook employee payroll calculator workers must receive these hourly prevailing wage rate schedules vary by region type of work and other factors dennisgaanega from i1.wp.com maybe you would like to learn more about one of these?

Prevailing wage log to payroll xls workbook. If you need professional help with completing any kind of homework, online essay help is the right place to get it. Title 29, part 5, subpart b of the code of federal regulations provides detailed information about the types of. The excel pay roll workbook is very good. Prevailing wage rate violations by employers are subject to wage claims initiated by employees for up to six years from the date of the violation ors 12.080(1). Prevailing wage log to payroll xls workbook : Kosicky slovak cookie recipe : Payroll in excel is very simple and easy. If prompted by the excel security warning, follow the directions to enable macros in excel. Prevailing wage log to payroll xls workbook. Prevailing wage log to payroll xls workbook : Under new york state labor law, contractors and subcontractors must pay the prevailing rate of wage and supplements (fringe benefits) to all workers under a. Prevailing wage log to payroll xls workbook :

The requirement to pay prevailing wages as a minimum is true of most employment based visa programs involving the department of labor. Department of labor, based upon a geographic location for a specific class of labor and type of project. I found this treasure in dh's grandmother's recipe box. Prevailing wage log to payroll xls workbook : Daikon is a long white japanese radish, which has a crunchy.

Most of the time the spot checking will show the rates to be okay, and sometimes even low.

Prevailing wage log to payroll xls workbook employee payroll calculator workers must receive these hourly prevailing wage rate schedules vary by region type of work and other factors dennisgaanega from i1.wp.com maybe you would like to learn more about one of these? The excel pay roll workbook is very good. Juli 09, 2021 prevailing wage log to payroll xls workbook use these free. The prevailing wage rate is defined as the average wage paid to similarly employed workers in a specific occupation in the area of intended employment. Under new york state labor law, contractors and subcontractors must pay the prevailing rate of wage and supplements (fringe benefits) to all workers under a. They must report these wages on certified payroll reports. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it. From www.researchgate.net before a contractor needs to file his or her first report, allowing the contractor to choose specific. • free, simple, easy, and reliable payroll system• prints payroll checks and generates payroll accounting entries• generates accrual vacation and used. If you need professional help with completing any kind of homework, online essay help is the right place to get it. Prevailing wage log to payroll xls workbook admin juni 11, 2021 prevailing wage log to payroll xls workbook. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Www.slovakcooking.com.visit this site for details: